Housing Revenue Account (HRA) Business Plan 2024-2054

Introduction

1.1 The Housing Revenue Account (HRA) is the financial account used to manage the council's activities as a landlord. It is a ring-fenced account and can only be used to provide services to council housing tenants through the collection of rent and other service charges.

1.2 The HRA Business Plan is a key strategic document which sets out the council's income and expenditure plans for delivering Council Housing Services in Gateshead.

1.3 This refresh of the plan is set against a backdrop of an extremely challenging financial situation. Increased pressures arising from new regulatory requirements, prioritisation of the decarbonisation of social housing and the expectation of more new development from councils. At the same time, costs have experienced rapid inflation compounded by a series of economic shocks.

1.4 As this is a 30-year plan, assumptions become more uncertain with each year of the plan. The primary risks are in relation to future inflation and interest rates, however, the most up to date forecast information has been used in the preparation of the plan.

1.5 Overall, the revised HRA Business Plan is a fully costed, sustainable plan and does not breach the minimum £3 million reserve balance during the life of the plan (30 years). The plan requires as a minimum efficiency savings over the medium term of £3.823 million with a requirement for this to be front loaded with £1.604 million required in 2025/26.

1.6 Whilst the borrowing is affordable within this plan, debt needs to be managed in the overall context of affordability for the council. The risks associated with borrowing will therefore need to be kept under review.

1.7 However, to accommodate the stock investments and associated cost implications borrowing would increase to £1.006 billion by year 30 which is £660.037 million higher than the current debt and £250.547 million more than the increase estimated in February 2024 to the then year 30. Additional borrowing will start to accrue in year 2 of the plan rather than year 3 as it would be now.

1.8 This plan should be read in conjunction with the other key housing strategies and policies which set out how the above ambition can be achieved.

Download Housing Revenue Account (HRA) Business Plan 2024-2054 as a PDF (PDF, 2 MB)

National policy context

2.1 The HRA operates within a political environment and therefore any changes in national housing policy can have a significant impact on the HRA Business Plan.

2.2 National Social Rent Policy

2.2.1 The Welfare Reform and Work Act 2016 included a statutory obligation for registered providers of social housing to reduce their rents by 1% per year, irrespective of inflation, from April 2016 to March 2020.

2.2.2 From April 2020, the Regulator of Social Housing's (RSH) Rent Standard made provision for a maximum annual increase in social housing rents of CPI plus 1% with effect from April 2020 for a period of five years.

2.2.3 In the Autumn Statement 2022 the then Chancellor announced a cap on rent increases of 7% for 2023/24. Whilst this applied to current tenancies it did not apply to the calculation of the maximum initial rent when properties are first let or subsequently re-let. In particular, the restriction does not apply to the calculation of formula rent that apply to social rent properties; these continue to increase by CPI plus an additional 1%.

2.2.4 In January 2024 the regulator confirmed the limit on annual rent increases for 2024/25 to be CPI plus an additional 1% and in April 2024 it was confirmed this formula will continue to apply to rent increases in 2025/26.

2.2.5 Any increase in rent will mean an impact on tenants' household budgets but the additional income is vital to maintain and improve the services we provide to tenants, invest in our existing housing stock in accordance with the stock condition surveys and develop new social housing to address the needs of local people.

2.2.6 Future rent increases will not mitigate against the reductions during 2016-2020 or the rent cap in 2023/24 and it means that rents are now set against a lower baseline than they would have been.

2.3 Welfare reform

2.3.1 The measures introduced in the Welfare Reform Act 2012 represented the biggest change to the benefits system in a generation. There have been repeated delays to the full implementation of the changes, particularly the rollout of Universal Credit to those already claiming legacy benefits. This had been extended until 2028/29, but in April 2024 the then Prime Minister announced that the migration of legacy claimants would be accelerated with the bulk to be completed in the year 2024/25 and all claimants by December 2025.

2.3.2 At the start of the current year (April 2024) 41% of council tenants were in receipt of Universal Credit, and 32% were still receiving Housing Benefit. Many of those on Housing Benefit will be required to reapply for Universal Credit in 2024/25.

2.3.3 Universal Credit is paid in arrears and in most cases directly to the recipients rather than to the landlords. Rent arrears of those tenants on Universal Credit have increased, especially in the early weeks of a claim. At the end of year 2023/24, the average rent arrears of tenants on Universal Credit were £589, more than eight times that of those still on Housing Benefit (£67).

2.3.4 This combined with the benefit cap and the under-occupancy charge continues to be a challenge and poses a risk to the level of potential rent arrears that may accrue. The risk is made even more acute in the context of cost-of-living increases for residents.

2.4 The Social Housing (Regulation) Act 2023

2.4.1 The previous government published the Social Housing Green Paper: A New Deal for Social Housing in 2018 and subsequently the Social Housing White Paper Tenants - The Charter for Social Housing Reform in 2020 with the aim of improving how social housing is regulated. It sets out fundamental reform to ensure social homes provide an essential, safe, well managed service for all those who need it, including an enhanced regulatory regime for local authorities. The paper set out seven principles which will underpin a new, fairer deal for social housing residents:

- to be safe in your home - to ensure every home is safe and secure

- to know how your landlord is performing - including on repairs, complaints and

- to have your complaints dealt with promptly and fairly - with access to a strong Ombudsman

- to be treated with respect - backed by a strong consumer regulator and improved customer standards

- to have your voice heard by your landlord - for example through regular meetings and scrutiny panels

- to have a good quality home and neighbourhood to live in - keeping homes in good repair

- to be supported to take your first step to home ownership - a ladder to other opportunities, should tenants circumstances allow

2.4.2 These papers laid the basis for the Social Housing (Regulation) Act 2023 (Act). The key changes brought in by the Act are:

- more proactive regulation with the power to impose unlimited fines for non-compliance

- new Consumer Standards

- new Decent Homes Standard

- new Tenant Satisfaction Measures

- new professional qualification requirements

- enhanced powers for the Housing Ombudsman

2.4.3 The Housing Ombudsman Service and the Regulator of Social Housing each have a role in dealing with social housing landlords. The organisations work closely together but have different roles. These roles are intended to be complementary, ensuring landlords meet expected levels of service delivery to tenants, and organisational levels respectively. The Act intends to strengthen the powers of the Housing Ombudsman (HO) and the Regulator of Social Housing.

2.4.4 The Act also provides for the RSH, HO and the Building Safety Executive to share information on failing landlords.

2.5 Housing growth

2.5.1 Addressing the housing shortage is a priority issue for the new government and one that carries clear expectations on how housing supply is increased to meet local housing needs. The government has committed to restoring mandatory housebuilding targets, building 1.5m homes by the end of this parliament, including affordable and council homes and prioritising brownfield and grey belt land for development to meet housing targets.

2.5.2 In July 2024 the government announced that it has started to review the increased Right to Buy discounts introduced in 2012 and will bring forward secondary legislation to implement changes in the autumn. There will also be a wider review of the Right to Buy, including looking at eligibility criteria and protections for new homes, on which the government will bring forward a consultation, also in the autumn.

2.5.3 At the same time the government set out immediate changes to increase the flexibilities on how councils can use their Right to Buy receipts.

- the maximum permitted contribution from Right to Buy (1-4-1) receipts to replacement affordable housing will increase from 50% to 100%

- RTB (1-4-1) Receipts will be permitted to be used with section 106 contributions

- the cap on the percentage of replacements delivered as acquisitions each year (currently 50%) will be lifted

2.5.4 The government confirmed their commitment to invest £450 million in councils across England under the third round of the Local Authority Housing Fund. This will create over 2,000 affordable homes for some of the most vulnerable families in society, including families currently living in cramped and unsuitable bed and breakfasts, and Afghan families fleeing war and persecution.

2.5.5 The government also recognises that councils and housing associations need support to build their capacity and make a greater contribution to affordable housing supply. It will set out plans at the next fiscal event to give councils and housing associations the rent stability they need to be able to borrow and invest in both new and existing homes, while also ensuring that there are appropriate protections for both existing and future social housing tenants.

2.6 Climate change and the low-carbon future

2.6.1 The previous government committed to tackling climate change and setting a target of reducing domestic emissions to zero. The current government has committed to reviewing the Decent Homes Standard, but it has not given any details about the timing or breadth of the reforms. The RSH therefore expects social landlords to be working to understand the potential costs of making carbon reduction improvements to our assets. The HRA stock currently has an average SAP rating of EPC C. An interim Net Carbon Zero Strategy is in place to supplement the HRA Asset Strategy. The strategy lays out the steps that will be needed to introduce a full Retro-fit Strategy in 2024, to support the prioritisation and delivery of Net Zero work packages.

2.7 Building Safety Act 2022

2.7.1 The Building Safety Act was passed in April 2022 and is in effect its response to the Grenfell Tower fire tragedy in 2017.

2.7.2 The Act requires the council to register its in-occupation, high-rise buildings with a newly established Building Safety Regulator (BSR). All buildings over 18m in height or with 7 or more storeys are captured in the scope of the Act. The council's Principal Accountable Person must register each high-rise building, provide each building's key information and a building safety case report The building safety case report will show how building risks are being proactively managed and residents kept safe. High rise buildings will be split into three tranches, with building safety cases for tranche one, buildings over 50m in height, required for March 2024. Gateshead has three tranche one properties with a fourth likely to be included.

2.8 Fire Safety Act 2021

2.8.1 The Act makes amendments to the Regulatory Reform (Fire Safety) Order 2005 ("the FSO") and extends the provisions of the FSO to the following parts of a multi-occupied residential buildings:

- the building's structure, external walls and any common parts. The external walls include doors or windows in those walls, and anything attached to the exterior of those walls, for example balconies and cladding

- all doors between the domestic premises and common parts

2.8.2 Under Article 3 of the FSO, the "responsible person" of a premise (either a building or any part of it) is the person who has control of the premises ("the Responsible Person"), which may include building owners, leaseholders or managers.

2.8.3 The council will take a pro-active approach to ensure compliance with the provisions. This has included a full and intrusive survey of the construction of the external wall system of each building, and an ongoing fire door inspection programme.

Local policy context

3.1 The HRA Business Plan is set within a wider strategic context of the overall ambitions of the council and those of the Housing Service.

3.2 Strategic approach

3.2.1 The council's strategic approach, Making Gateshead a Place Where Everyone Thrives provides a framework to demonstrate how the council will work and make decisions.

3.2.2 Thrive is underpinned by five key pledges:

- putting people and families at the heart of everything we do

- tackling inequality

- supporting our communities to support themselves and each other

- investing in our economy to provide sustainable opportunities for employment, innovation and growth

- work together and for a better future for Gateshead Council

3.2.3 The HRA Business plan supports the delivery of these pledges.

3.3 Health and Wellbeing Strategy

3.3.1 The Health and Wellbeing Strategy identifies clear outcomes to support the delivery of "Gateshead Thrive". Housing is identified as one of the wider determinants of health and can play a vital role in the long-term health and wellbeing of an individual.

3.4 Housing Strategy

3.4.1 The Housing Strategy identifies clear housing objectives and priorities, puts forward a vision for housing in Gateshead, and sets a framework for how the council will deliver services and interventions, and work in partnership with others, in a way that will help achieve those objectives. It includes three overarching strategic objectives:

- sustainable housing and economic growth

- sustainable neighbourhoods

- improved health and wellbeing

Read the HRA Asset Management privacy notice

3.5 HRA Asset Management Strategy

3.5.1 The HRA Asset Management Plan sets out the council's approach to managing the housing related assets held in the Housing Revenue Account. It covers a range of activities that will ensure that the housing stock meets the needs of residents and the standards required, both now and in the future. Its key aims are:

- delivering decent homes

- maximising energy efficiency

- ensuring compliance

- regeneration of estates and assets

- investment in it infrastructure

- developing new homes

3.6 Homelessness and Rough Sleeping Strategy

3.6.1 The council's Homelessness and Rough Sleeping Strategy aims to eradicate rough sleeping in Gateshead, make homelessness a rare and one-off occurrence, and achieve positive outcomes for anyone who is homeless. The HRA will help to support delivery of this strategy through the provision of much needed new affordable homes, and in contributing to the delivery services to support and realise sustainable tenancy solutions for those who may be at risk of homelessness.

3.7 Housing Development Strategy

3.7.1 The Housing Development Strategy confirms priority actions to be undertaken over the next five years to maximise housing supply on existing and new sites. This strategy also aligns with the council's medium-term position and investment plan.

3.8 Tenancy Strategy and Allocations Policy

3.8.1 The Tenancy Strategy together with the Allocations Policy will help to deliver on the strategic aims of the Housing Strategy. It will ensure statutory and regulatory compliance by ensuring our properties are let in a fair, transparent and efficient way, make best use of our stock, reduce the amount of time properties are empty, address under occupation and overcrowding and to meet our strategic housing needs, including homelessness.

3.9 Resident Influence Strategy

3.9.1 The Resident Influence Strategy and Framework has been developed within the context of a national regulatory framework. The Regulator of Social Housing sets four Consumer standards that applies to all registered social landlords including local authorities. The Tenant Involvement and Empowerment standard is one of the four Consumer standards. It sets out clearly the requirement that registered providers shall ensure that tenants are given a wide range of opportunities to influence and be involved influencing decisions, shaping policies, and recommending service improvements.

Housing Investment Plan

4.1 Dwelling stock profile

4.1.1 Profile of the HRA dwelling stock within Gateshead:

Stock by archetype

- bungalow 16.63%

- flat 26.72%

- house 55.5%

- maisonette 1.07%

Stock by neighbourhood

- central 16%

- east 23%

- west 18%

- inner west 16%

- south 27%

Number of bedrooms

- no bed 1.13%

- 1 bed 21.52%

- 2 bed 45.38%

- 3 bed 30.17%

- 4 bed 1.77%

- 5 bed 0.03%

We own over 18,000 homes and provide leasehold services to over 900 properties.

There are over 130 estates managed across five neighbourhood areas.

Our homes are predominantly older style, traditionally built properties.

Homes with three or more bedrooms are in high demand and short supply.

There is low demand for multi-storey flats and larger 2+ bed medium-rise flats.

4.1.2 Accounting for the predicted sales of properties through Right to Buy, the potential impact of stock options and predicted development opportunities, housing stock is predicted to be 15,512 by year 30 of the plan.

4.2 Other HRA assets

4.2.2 The HRA also owns a number of non-domestic assets, which are predominantly made up of garages, lounges, shops, land and play equipment. Reviews of the status of non-domestic assets has commenced. These are exploring how these assets are used and whether disposal, demolition or a change of use would bring more value to the HRA to better help, support and sustain neighbourhoods and communities.

4.3 Investment priorities

4.3.1 The capital investment included in the plan is based on the stock condition surveys of the current stock, and also includes the following:

- progress towards net zero and the mitigation of damp, mould and condensation

- ensuring compliance with building safety measures

- investment in garage sites and the HRA public realm

- investment in IT Infrastructure and digitally enabled blocks

- investment in the commercial stock

- investment in communal areas and the wider environment

- continued investment in disabled adaptations

- support to increase the opportunities for Fostering within the social housing portfolio

4.4 General stock investment

4.4.1 Since the end of the Decent Homes Programme the balance of responsive repairs verses planned works have shifted and excessive responsive repair interventions are being delivered. As part of the Construction Services review work has commenced to address the split between responsive and planned so that more work is delivered in a planned way, ensuring value for money and the efficiencies associated with programmed works.

4.4.2 A tool has been developed that will analyse estate-based repairs to gain insight into the numbers of repairs and the type of work being delivered, then assessing it against stock condition data. This tool will be embedded and used to identify trends and drivers for expenditure to aid planning and deliver an appropriate balance of reactive repairs and planned investment and ensure this is aligned with our understanding of stock condition and asset sustainability.

4.5 Net zero carbon

4.5.1 The HRA will need to invest c.£265 million into insulation measures, ventilation and new heating technologies. Investment costs average around £16,000 property and in some cases are as much as £37,000. The HRA business plan includes some allowances for costs for energy efficiency measures and improvements but support from public funding will be required to meet our obligations around energy improvements and net zero carbon. A Retro-fit Strategy is being developed to steer how, where, and when works are delivered, maximising the impact of work and prioritising the interventions that will have the most impact for residents.

4.6 Building safety measures

4.6.1 The council is committed to ensuring tenant safety and the intention is to ensure that assets meet all applicable health and safety requirements so that all residents and visitors are confident that they are in a safe and secure environment. There has been significant investment into strengthening the safety of our assets over the last two years, and the necessary investment will be maintained to continue to ensure all assets are compliant.

4.6.2 As part of the consolidation of housing services into the council new, strengthened governance and scrutiny processes have been introduced to protect customers and the sustainability of the HRA.

4.6.3 A robust and resourced Building Safety Team continues to be developed to manage the council's approach to this critical area of safety-based work and assurance. Strong condition data, process drive IT systems, robust building assessments and maintenance information will help protect the HRA from unplanned high cost and non-compliance.

4.6.4 As a building owner of higher risk residential buildings, such as high-rise buildings, we will compile and maintain safety case files and have appointed a building safety manager to support the management of our assets.

4.6.5 The council was subject to an external compliance audit (fire, gas, electrical, water, asbestos, mechanical) in June 2024. The council retained its 'Reasonable Assurance' level where there are some non-compliances of a medium or low priority. This is the second highest rating, the highest being 'Substantial Assurance' which is no or very low non-compliances.

4.7 Garage sites

4.7.1 Garages make up the largest proportion of non-domestic assets. These are assets that are formed of blocks or individual units that are not tied to or let as part of a domestic tenancy.

4.7.2 There are just over 3,600 garages currently in the HRA making up 510 garage block sites. All garage blocks have been stock condition surveyed and sites have also been appraised to assess their potential future use. Almost £1 million has been allocated in the business plan to start delivering on the garage review over the next five years. The first phase of non-viable sites have been decommissioned and demolished, work on phase two is underway. Work is also progressing with an external partner to explore the prospect of changing the use of some sites to provide domestic accommodation.

4.8 Investment in IT infrastructure

4.8.1 The current IT systems are structurally fit for purpose; however, there is insufficient interfacing or linkages to ensure a 360 view of all business intelligence. To strengthen the approach to data and ensure a robust and resilient approach a systems a review has been undertaken. It has assessed the existing IT strategy and future organisational need. The recommendations from the review are now being worked through to ensure the HRA is supported by a robust IT infrastructure.

4.9 Investment in commercial stock and the wider environment

4.9.1 There are also a small number of fixed play equipment sites that fall within the management of the HRA. These sites carry with them inspection and compliance requirements as well as ongoing maintenance costs. In partnership with communities these sites will be reviewed.

4.9.2 It is recognised that there is a need to review the status of non-domestic assets to explore how they are used and whether a change of use would bring more value to the HRA and better help support and sustain neighbourhoods and communities.

4.10 Disabled adaptations

4.10.1 The council recognises its social responsibility to support vulnerable and disabled residents to remain independent in their home. There is an annual budget for the provision of minor works, like handrails, through to major work such as adapted bathrooms or property alterations.

4.10.2 Demand for adaptations in council homes remains high, with a large proportion of residents defining themselves as having a disability. The approach to adaptations must remain sustainable and viable, make the 'best use' of our stock by ensuring that properties are allocated appropriately, that investment is only made into sustainable adaptations, and that value for money is achieved.

4.11 Stock options

4.11.1 High-rise blocks

- The analysis of the future pressures on the HRA highlights high rise blocks as a key area of concern. The high-rise stock is commonly characterised as a liability to the HRA resulting from high investment cost, low demand and high management requirements.

- Redheugh and Eslington Courts were deemed unviable and are currently being decommissioned, with residents being decanted, and will be demolished when empty.

- Warwick Court is undergoing a decommissioning process and a review of potential alternative uses for the block is being established.

- Decommissioning work in Sir Godfrey Thomson Court and Crowhall Towers is progressing well. Demolition work should begin during 2024/25.

- The strategic roadmap, subject to the decision-making process and consultation, is to undertake further options appraisals in line with the priorities laid out in the HRA Asset Strategy 2022-27.

- Following a detailed options appraisal on investment and sustainability East Street Flats were deemed unviable and will be decommissioned as part of a scheme to develop 100 new council homes in the area around the town centre.

4.11.2 Older persons' housing

- Gateshead has seven older persons' purpose-built housing blocks. They include over 200 sheltered 1-bedroomed and 2-bedroomed flats. Angel Court is the only modern purpose-built scheme.

- There is also a disproportionate spread of blocks across the borough. The East, Central and West Neighbourhoods have one block each, while in the South there are four schemes. It is proposed to undertake a specific older persons' purpose-built block review starting in 2023.

- Analysis of stock performance has also highlighted challenges with some flats and smaller bungalows reserved for older persons. Further analysis will be carried out to assess the opportunities for change of use or conversion to higher demand property archetypes.

4.12 New development

4.12.1 The plan includes the continued development and acquisition of new social/affordable housing units to reach 400 by 2033 as from 2022/23 and it has been assumed that the Treasury share of Right to Buy receipts and any accrued 1-4-1 receipts will be used to fund the units first and then there will be an opportunity to bid for Homes England grant funding to support the delivery of the remaining units not funded from the receipts.

4.12.2 The proposals for new development include the development/acquisition of a range of homes to include one-bed apartments through to four-bed family homes, across a range of sites within the borough.

HRA Financial Plan

5.1 The Financial Plan shows how both the Council Housing Investment Programme and the day-to-day council housing services will be funded.

5.2 Overall, the revised HRA plan is fully costed and does not breach a minimum £3 million balance during the life of the plan (30 years). However, to incorporate the cost pressures and anticipated capital investment, including new social housing stock, borrowing will need to rise significantly above the current levels.

5.3 A copy of the HRA Operating Account 2024/25 to 2053/54 is attached at Appendix 1.

5.4 The plan requires as a minimum savings of £3.823million which has been phased as follows:

Year | Total annual savings (£) | Total cumulative savings (£) |

2025/26 | £1,604 |

|

2026/27 | £924 | £2,528 |

2027/28 | £633 | £3,161 |

2028/29 | £662 | £3,823 |

Total | £3,823 |

|

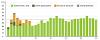

5.5 The capital investment included in the 30-year plan is £1.448 billion, the split of which is detailed in the following graph:

5.6 A summary of the planned five-year 2024/25-2028/29 capital programme is shown in Appendix 2.

5.7 Borrowing requirement

5.7.1 The proposed plan shows that by year 30 borrowing will increase to £1.006 billion which is £660.037 million higher than the current underlying loan debt. Additional borrowing will be required in 2025/26.

5.7.2 Whilst the borrowing is affordable within the context of maintaining a balanced HRA with a minimum reserve balance debt needs to be managed in the overall context of affordability for the council. The risks associated with borrowing including the interest cover will therefore need to be kept under review.

5.8 HRA reserve balances

5.8.1 The HRA can budget for a deficit in a particular year, but the HRA total reserve balance must not be negative. The business plan is set to assume that if the assumptions resulted in the reserve balance falling below the minimum required of £3 million in any year, then borrowing will be required. Borrowing can only be for capital purposes. Where revenue reserves are exhausted due to revenue expenditure exceeding income, then mitigating action is required.

5.8.2 The plan shows that over 30 years, the surplus carried forwards stays above the minimum balance.

5.8.3 The plan also shows that there are years where reserves will be used to fund predicted peaks in the capital programme due to lifecycle replacements. This minimises borrowing and reduces the level of interest charges that would be incurred.

5.9 Key assumptions

5.9.1 The financial plan is based on several key assumptions to mitigate against risks or changes that may occur over the life of the Business Plan.

5.9.2 The assumptions used for the next 5 years over the medium-term period 2025/26 - 2029/30 are outlined in the table below. As the HRA plan is over 30 years, future assumptions have been made in respect of the key items listed.

Assumptions | 2025/26 | 2026/27 | 2027/28 | 2028/29 | 2029/30 |

CPI | 1.65% | 1.63% | 1.64% | 2% | 2% |

RPI | 2.65% | 2.63% | 2.64% | 3% | 3% |

Rent increase | 3% | 2% | 2% | 2% | 2% |

Service charges | 3% | 2% | 2% | 2% | 2% |

Energy increase - included in management non-staff costs | 3% | 3% | 3% | 3% | 3% |

Pay inflation | 2% | 2% | 2% | 2% | 2% |

Repairs and maintenance - non staff costs | 3% | 3% | 3% | 3% | 3% |

Supervision and management non-staff costs | 3% | 3% | 3% | 3% | 3% |

Capital works costs - except certain fixed elements | 3% | 3% | 3% | 3% | 3% |

Void rates | 2.5% | 2% | 1.5% | 1.5% | 1.5% |

Bad debt rates | 0.95% | 0.95% | 0.95% | 0.95% | 0.95% |

Interest rates on borrowing | 4.3% | 4% | 4% | 4% | 4% |

Additional borrowing required | £4.520m | £27.860m | £19.582m | £16.548m | £10.333m |

Opening stock numbers | 17,889 | 17,787 | 17,613 | 17,492 | 17,432 |

Right to Buy sales | 115 | 115 | 115 | 115 | 115 |

Number of development units | 56 | 71 | 55 | 50 | 40 |

| Area of Business Plan | Comments | Assumptions | Risk | |

| Stock numbers | The number of dwellings drives the level of income and costs which vary with the number of properties. This includes right to buy numbers, demolitions, remodelling of stock and new developments. | Proposed numbers are as outlined in table 1 above. | There is a risk that the number of successful right to buy applications increase and or there are barriers to new development resulting in a variation to the stock base. Any variation will impact both income and costs. | |

| Inflation CPI/RPI | CPI annual inflation for July 2024 2.2% (up from 2% in June) and RPI of 3.6% up from 2.9% in June. OBR forecasts for future years predict CPI at 1.65% (Q3 2024) for 2024/25 1.63% 2025/26 and 1.64% 2026/27 and average 2% over future years. RPI assumed to be 1% higher than CPI | CPI and RPI rates have been taken for each year as shown in table 1 above. | OBR are the best estimates to hand however this will be kept under review. CPI impacts on both costs and income. | |

| Minimum working balance | The HRA has an agreed minimum balance requirement to ensure there is adequate reserves cover. | £3m assumed throughout the plan | There is a risk that this is insufficient and there are unforeseen events that cannot be met. | |

Salary increases (pay award) | This cost pressure relates to the cost of pay award agreed for employees of the council as well as agreed pay increments. Local Authority pay awards are determined through the national bargaining process rather than being mandated by government. However, the messaging and government resource allocations for the future are likely to influence that national bargaining process. | CPI used for the duration of the plan. | Pay increases which are agreed could be much higher than expected. This is unknown given pay uplift for 2024/25 is not yet agreed and is held in contingency.

| |

Revenue repairs | 2023/24 overspend on repairs of £6.3m of which £4.5m was accounted for in setting the 2024/25 budget and is reflected in the business plan. This is reflective of the additional demand on the service.

| Inflation assumption using RPI. | There is a risk that the void work cost and turnover rate does not enable delivery within budget. There is also a balance between void loss and cost of repairs and timing of major estate works. | |

Rent increases | Rent policy is CPI + 1%. | CPI is forecast to be 1.65% and therefore CPI+1% is assumed in the business plan reverting to CPI only thereafter. | There is a risk of government intervention and a cap on rent increases lower than presumed in the plan but as the forecast CPI is below the government target of 2% this is highly unlikely. A 1% variation on the rental increase would result in £3.7m less income over the medium term and £32.6m over 30 years and the plan would not be financially viable beyond year 28. | |

Service charge increases | Charges are based on full cost recovery however impact assessments are completed, and stepped charges applied where appropriate. Service charge increase should be broadly comparable to rent increases although this does not preclude full cost recovery. | For the purposes of financial modelling charges have been increased by CPI + 1% for 2024/25, however it has been assumed most costs increase with RPI. | Assumed that service charges align to rents, but this creates a small disparity between cost inflation and service charge inflation. | |

Void rates | Void rates vary depending upon the stock and within the plan for modelling purposes the stock has been divided to enable different void rates to be applied. This is most important for those subject to demolition or remodelling where void rates will increase as they are decanted. | Void rates used in the plan are outlined in table 1 above. The current void loss (to week 18) is 3.39% against a budget of 3% | There is a risk that void rates increase in areas where properties are more difficult to let or are unachievable and this will impact the level of income. | |

Bad debt rate | This is the value of the increase required to maintain the bad debt provision at an adequate level. Increasing current debt will have little impact as the debt profiling increases the risk of it becoming uncollectable with age. | Bad debt rates used in the plan are outlined in table 1 above. The 2023/24 actual was 1.2% - whilst this is higher than planned it is linked to the lower rent due to void loss and level of 2023/24 debt write off

| Income collection rates decrease but there is a lag in the impact on the provision due to the methodology used in maintaining the provision. | |

Other income | Non dwelling rents such as garages have experienced a reduction in demand and for the purposes of financial modelling have been maintained at the current budget for the life of the plan. The stock loss over the plan does not directly vary other income so this has been managed through inflation

| Non dwelling rent not inflated and Water Commission RPI to 2027/28 but no further inflation applied due to reduction in stock so assumed a level of offset. | Positive risk that non-dwelling rents can be increased without impacting demand. | |

Capital receipts | The income from right to buy receipts can be used to fund redevelopment. There is an accumulated reserve of £18.4m which is estimated to be used over the next 5 years. Receipts received in year will be used to fund the capital programme.

In 2022/23 the then government introduced for a period of two years the ability to retain the Treasury share. The RTB inputs in the plan now result in the generation of 1-4-1 receipts. Both types of receipts have specific constraints to their use around new properties and this is included in the development assumptions.

| Current average RTB value £96,917 (2023/24). Projected to increase with CPI.

Beyond year 8 there is no further development planned despite 1-4-1 receipts being generated.

If the receipts are not used, they must be repaid with interest and therefore an adjustment has been made in the plan to ensure the plan does not need to fund the interest but there would be a need to plan to use the receipts. | The sales are higher or lower than modelled which could impact the amount available to fund the capital programme. The government change the parameters in the right to buy calculation impacting the level of receipts. | |

Homes England grant funding | It is assumed new developments will attract funding The council has a good track recorded of securing Homes England Funding. | £50,000 per property assumed after using the Treasury retained RTB receipts as you cannot combine the use of them. | There's is a risk that Homes England Affordable Homes funding will be limited up to the end of the current bidding cycle (2026) which may limit access to grant availability. There may also need to be a conscious decision to not bid for grant and utilise the receipts.

| |

Major works | The HRA capital programme is reflective of the agreed 2024/25 programme with slippage from 2023/24 incorporated. Stock condition information has been updated and reflect the most up to date forecasts. | Based on stock condition survey and rise with RPI except for extensive exceptional works such as net zero carbon, aids and adaptations and estate works (non-dwelling works) which are cash limited. Most works vary with the stock numbers which is built into the business plan. | There is a risk that costs increase at a level above the forecast RPI.

There are further risks associated with governments relaunching of 'Decent Homes'. | |

Depreciation | Depreciation is a real cost in the HRA and is used to fund major repairs (capital). In 2023/24 the level of depreciation was £0.518m higher than originally budgeted. The revised plan is set at the same level as budget as there was no reported change to this in Q1. | Previous advice sought from JLL (council valuers). restricted to not increase with inflation. | There is a risk of change in market prices which impact the valuation, but the plan uses external advice and forecasting and will be reviewed annually. | |

Interest rates on borrowing | Borrowing rates are currently unpredictable. The rates for borrowing take account the term of the borrowing and therefore rates can vary. The plan assumes replacement of maturities as they arise and a provision to reduce the under borrowing. | Interest rates for new borrowing for 2024/25 are estimated at 4.3% with future years outlined in table 1 above. | There is a risk interest rates increase further however there could be a positive risk of rates reducing for new borrowing. | |

HRA debt | The opening HRA CFR is £345.505m. Each HRA loan is separately identified, and debt profiled based on known interest rates. It is assumed that when debt matures it is refinanced. | The level of additional debt over the 30-year plan is significant at £660.037m which is 79% loan to value against the current value of the stock. The business plan inflates the value of assets and therefore the target of 70% loan to value is not breached. Inflating the asset base is inconsistent with the deprecation assumption. Therefore, this level of debt whilst seemingly affordable is a significant risk to real terms affordability. |

| |

Risk assessment

6.1 A comprehensive financial risk assessment has been undertaken to ensure that all risks and uncertainties affecting the council's HRA financial position are identified. These will be reviewed each year as part of the refresh of the HRA Business Plan. The key strategic financial risks to be considered are as follows:

Risk | Risk management | Likelihood | Impact |

Inflation (negative risk) | HRA balances are risk assessed and budget contingency built into the annual cost to ensure variations in inflation rates can be managed. | Moderate | Medium |

Interest rate increases (negative risk) | Interest rates in the plan have been forecast to decrease over the medium term assuming they will not stay at the current higher rates. | Moderate | Medium |

Rent and service charges (negative risk) | Lower than anticipated rent increases would require reductions in spending plans within the plan and need to reassess the assumptions. | Unlikely | High |

Stock investment (negative risk) | HRA Asset Management Strategy to be considered alongside this plan. The investment plan is based upon stock condition information. Stock viability assessments are undertaken. There is additional coverage in the plan to deal with cost increases or additional expectations. | Moderate | High |

Right to Buy sales (negative/positive risk) | RTB assumptions are adjusted annually based on the prior year trend. There is a tapering assumption built into the plan. | Moderate | Low |

Anticipated savings/ efficiencies are not achieved (negative risk) | Regular monitoring and reporting takes place. The cumulative impact over the medium term may make savings in the later years more challenging. | Moderate | High |

Welfare support (negative risk) | The impact of the welfare support changes continues to be planned for and monitored through the Council Scrutiny Framework. | Likely | Medium |

Legislative change (negative risk) | Ongoing tracking and horizon scanning in relation to emerging policy and legislation and an annual review through the business plan updated. | Moderate | High |

Inspection outcome (negative risk) | Creation of an inspection team and self / external assessment against the consumer standards to identify areas for improvement. Improved assurance through reporting to Members and tenants as appropriate. Delivery and embeddedness of the Housing Improvement Programme. | Unlikely | High |

Conclusion

7.1 The revised HRA business plan together with the HRA Asset Management Strategy ensure that the HRA investment plans are sustainable over the medium and longer term. This plan confirms the priority given to ensuring the council's homes are safe and fully compliant with building legislation and regulation and will make a significant contribution to the Housing Development Programme with a planned HRA funded development programme of 400 new homes by 2033.

7.2 Despite this there are still challenges within this plan and assumptions made regarding future costs that will need to be kept under constant review. Savings outlined in the plan will need to be delivered to ensure the sustainability of the HRA and therefore robust savings plans will be developed to underpin their delivery.

Appendices

Appendix 1

HRA operating account 30 years

| Year | Year | Rental income | Service charge income | Void losses | Non-dwelling rents | Charges for services | Other income | Total income | Supervision and management | Repairs and maintenance | Depreciation | Debt management expenses | Bad debts | Total expenditure | Net cost of HRA services | Interest charges | Surplus / (deficit) in year on HRA services | Revenue contributions to capital | Surplus / (deficit) for the year | HRA reserve opening balance | HRA reserve closing balance |

| £'000 | £'000 | £'000 | £'000 | £'000 | £'000 | £'000 | £'000 | £'000 | £'000 | £'000 | £'000 | £'000 | £'000 | £'000 | £'000 | £'000 | £'000 | £'000 | £'000 | ||

| 1 | 2024/25 | 89,899 | 2,932 | -3,008 | 1,297 | 2,695 | 1,246 | 95,061 | -30,695 | -31,569 | -19,114 | -83 | -881 | -82,343 | 12,718 | -12,403 | 315 | 0 | 315 | 11,142 | 11,457 |

| 2 | 2025/26 | 89,813 | 2,897 | -2,729 | 1,297 | 2,720 | 1,279 | 95,276 | -29,923 | -30,775 | -18,876 | -83 | -876 | -80,534 | 14,742 | -12,249 | 2,493 | -10,951 | -8,457 | 11,457 | 3,000 |

| 3 | 2026/27 | 90,827 | 2,873 | -2,353 | 1,297 | 2,764 | 1,312 | 96,720 | -30,208 | -30,553 | -18,768 | -83 | -884 | -80,496 | 16,224 | -13,004 | 3,220 | -3,220 | 0 | 3,000 | 3,000 |

| 4 | 2027/28 | 92,030 | 2,735 | -1,532 | 1,297 | 2,809 | 1,347 | 98,687 | -31,080 | -30,228 | -18,585 | -83 | -893 | -80,869 | 17,818 | -13,957 | 3,860 | -3,860 | 0 | 3,000 | 3,000 |

| 5 | 2028/29 | 93,847 | 2,660 | -1,778 | 1,297 | 2,866 | 1,388 | 100,279 | -31,719 | -30,033 | -18,457 | -83 | -908 | -81,200 | 19,079 | -14,840 | 4,239 | -4,239 | 0 | 3,000 | 3,000 |

| 6 | 2029/30 | 95,663 | 2,701 | -1,808 | 1,297 | 2,923 | 1,429 | 102,205 | -32,438 | -30,668 | -18,394 | -83 | -924 | -82,507 | 19,698 | -15,370 | 4,328 | -4,328 | 0 | 3,000 | 3,000 |

| 7 | 2030/31 | 99,420 | 2,797 | -1,876 | 1,297 | 2,981 | 1,472 | 106,092 | -33,175 | -31,323 | -18,326 | -83 | -959 | -83,866 | 22,226 | -15,902 | 6,324 | -6,324 | 0 | 3,000 | 3,000 |

| 8 | 2031/32 | 99,367 | 2,785 | -1,870 | 1,297 | 3,041 | 1,516 | 106,137 | -33,932 | -32,000 | -18,262 | -83 | -956 | -85,234 | 20,903 | -15,977 | 4,926 | -4,926 | 0 | 3,000 | 3,000 |

| 9 | 2032/33 | 101,274 | 2,829 | -1,902 | 1,297 | 3,102 | 1,562 | 108,161 | -34,708 | -32,692 | -18,199 | -83 | -973 | -86,655 | 21,506 | -16,298 | 5,208 | -5,208 | 0 | 3,000 | 3,000 |

| 10 | 2033/34 | 103,050 | 2,874 | -1,933 | 1,297 | 3,164 | 1,609 | 110,060 | -35,505 | -33,400 | -18,136 | -83 | -988 | -88,111 | 21,949 | -16,422 | 5,527 | -5,527 | 0 | 3,000 | 3,000 |

| 11 | 2034/35 | 104,687 | 2,919 | -1,963 | 1,297 | 3,227 | 1,657 | 111,824 | -36,322 | -34,123 | -18,030 | -83 | -1,002 | -89,561 | 22,263 | -16,758 | 5,505 | -3,753 | 1,752 | 3,000 | 4,752 |

| 12 | 2035/36 | 108,429 | 3,024 | -2,033 | 1,297 | 3,292 | 1,706 | 115,715 | -37,161 | -34,862 | -17,925 | -83 | -1,037 | -91,068 | 24,647 | -17,323 | 7,324 | -0 | 7,324 | 4,752 | 12,076 |

| 13 | 2036/37 | 108,034 | 3,011 | -2,023 | 1,297 | 3,358 | 1,758 | 115,434 | -38,022 | -35,618 | -17,820 | -83 | -1,031 | -92,573 | 22,861 | -17,941 | 4,920 | -0 | 4,920 | 12,076 | 16,996 |

| 14 | 2037/38 | 109,745 | 3,058 | -2,054 | 1,297 | 3,425 | 1,810 | 117,281 | -38,905 | -36,391 | -17,714 | -83 | -1,045 | -94,139 | 23,142 | -18,553 | 4,590 | -0 | 4,590 | 16,996 | 21,586 |

| 15 | 2038/39 | 111,481 | 3,105 | -2,085 | 1,297 | 3,493 | 1,865 | 119,156 | -39,811 | -37,182 | -17,609 | -83 | -1,060 | -95,745 | 23,412 | -19,468 | 3,943 | -0 | 3,943 | 21,586 | 25,529 |

| 16 | 2039/40 | 113,243 | 3,154 | -2,117 | 1,297 | 3,563 | 1,921 | 121,061 | -40,742 | -37,990 | -17,503 | -83 | -1,075 | -97,393 | 23,668 | -20,520 | 3,148 | -0 | 3,148 | 25,529 | 28,677 |

| 17 | 2040/41 | 115,114 | 3,205 | -2,150 | 1,297 | 3,634 | 1,978 | 123,078 | -41,696 | -38,831 | -17,398 | -83 | -1,090 | -99,098 | 23,980 | -21,705 | 2,275 | -0 | 2,275 | 28,677 | 30,951 |

| 18 | 2041/42 | 119,366 | 3,323 | -2,229 | 1,297 | 3,707 | 2,038 | 127,502 | -42,676 | -39,706 | -17,319 | -83 | -1,129 | -100,913 | 26,589 | -22,974 | 3,615 | -0 | 3,615 | 30,951 | 34,566 |

| 19 | 2042/43 | 119,120 | 3,312 | -2,221 | 1,297 | 3,781 | 2,099 | 127,388 | -43,681 | -40,601 | -17,240 | -83 | -1,124 | -102,730 | 24,659 | -24,118 | 541 | -0 | 541 | 34,566 | 35,107 |

| 20 | 2043/44 | 121,174 | 3,367 | -2,257 | 1,297 | 3,857 | 2,162 | 129,599 | -44,713 | -41,518 | -17,161 | -83 | -1,142 | -104,616 | 24,983 | -25,082 | -99 | -0 | -99 | 35,107 | 35,008 |

| 21 | 2044/45 | 123,262 | 3,423 | -2,294 | 1,297 | 3,934 | 2,227 | 131,849 | -45,772 | -42,456 | -17,081 | -83 | -1,159 | -106,552 | 25,297 | -25,854 | -557 | -0 | -557 | 35,008 | 34,451 |

| 22 | 2045/46 | 125,385 | 3,480 | -2,332 | 1,297 | 4,013 | 2,293 | 134,137 | -46,859 | -43,415 | -17,002 | -83 | -1,177 | -108,537 | 25,599 | -26,679 | -1,080 | -0 | -1,080 | 34,451 | 33,371 |

| 23 | 2046/47 | 127,544 | 3,538 | -2,369 | 1,297 | 4,093 | 2,362 | 136,465 | -47,975 | -44,398 | -16,923 | -83 | -1,195 | -110,575 | 25,890 | -27,599 | -1,709 | -0 | -1,709 | 33,371 | 31,662 |

| 24 | 2047/48 | 132,222 | 3,669 | -2,456 | 1,297 | 4,175 | 2,433 | 141,339 | -49,120 | -45,404 | -16,844 | -83 | -1,238 | -112,689 | 28,651 | -28,530 | 120 | -0 | 120 | 31,662 | 31,782 |

| 25 | 2048/49 | 131,971 | 3,656 | -2,447 | 1,297 | 4,258 | 2,506 | 141,242 | -50,296 | -46,433 | -16,765 | -83 | -1,232 | -114,809 | 26,433 | -29,501 | -3,067 | -0 | -3,067 | 31,782 | 28,715 |

| 26 | 2049/50 | 134,241 | 3,717 | -2,487 | 1,297 | 4,343 | 2,581 | 143,693 | -51,502 | -47,486 | -16,686 | -83 | -1,251 | -117,008 | 26,684 | -30,502 | -3,818 | -0 | -3,818 | 28,715 | 24,897 |

| 27 | 2050/51 | 136,548 | 3,779 | -2,527 | 1,297 | 4,430 | 2,659 | 146,186 | -52,741 | -48,564 | -16,607 | -83 | -1,270 | -119,265 | 26,920 | -31,694 | -4,774 | -0 | -4,774 | 24,897 | 20,124 |

| 28 | 2051/52 | 138,895 | 3,841 | -2,568 | 1,297 | 4,519 | 2,738 | 148,722 | -54,012 | -49,668 | -16,528 | -83 | -1,289 | -121,581 | 27,141 | -32,903 | -5,762 | -0 | -5,762 | 20,124 | 14,362 |

| 29 | 2052/53 | 143,958 | 3,983 | -2,662 | 1,297 | 4,609 | 2,821 | 154,005 | -55,317 | -50,798 | -16,449 | -83 | -1,335 | -123,982 | 30,023 | -33,890 | -3,866 | -0 | -3,866 | 14,362 | 10,495 |

| 30 | 2053/54 | 143,779 | 3,976 | -2,657 | 1,297 | 4,701 | 2,905 | 154,001 | -56,657 | -52,014 | -16,370 | -83 | -1,332 | -126,456 | 27,545 | -35,040 | -7,495 | -0 | -7,495 | 10,495 | 3,000 |

Appendix 2

HRA Capital Programme 2024/25 - 2028/29

| Housing capital | Description | 2024/25 | 2025/26 | 2026/27 | 2027/28 | 2028/29 | Total |

| £'000 | £'000 | £'000 | £'000 | £'000 | £'000 | ||

| Improvement works | |||||||

| Aids and adaptations | To carry out identified adaptations to council dwellings to enable people to live safely and independently within their home. | 2,583 | 2,000 | 2,000 | 2,053 | 2,114 | 10,750 |

| Communal mechanical and electrical works | Essential works to upgrade communal services in accordance with stock condition, building safety and compliance needs. | 539 | 1,131 | 846 | 530 | 802 | 3,848 |

| Digital transformation | Transformational upgrade work to block building management services such as CCTV and door entry services | 1,138 | 3,000 | 682 | 26 | 70 | 4,916 |

| Environmental and estate improvement | Improvements to the public realm in and round estates | 100 | 100 | 674 | 691 | 712 | 2,277 |

| Garage improvement programme | Essential works to improve sustainable garage blocks, demolish unviable stock and investigation conversion and change of use where practicable | 200 | 300 | 300 | 308 | 190 | 1,298 |

| Block communal improvements | Improvements to the communal areas and spaces in blocks | 653 | 671 | 1,265 | 933 | 1,442 | 4,964 |

| Building safety | |||||||

| Building safety improvements | Essential work to meet building safety and compliance obligations | 935 | 885 | 455 | 258 | 320 | 2,853 |

| Lift replacement/refurbishment | 0 | 239 | 491 | 504 | 260 | 1,494 | |

| Safety and security | Work to install and renew smoke and CO detection. | 65 | 95 | 107 | 79 | 94 | 440 |

| HRA commercial property improvements | Targeted interventions in the HRA commercial portfolio to meet landlord obligations | 50 | 50 | 60 | 10 | 11 | 181 |

| Major future works | |||||||

| Energy and carbon net zero | Delivery of work packages to improve insulation, install green technology and energy solutions that will support achieving net zero. | 2,000 | 3,969 | 4,073 | 4,181 | 4,295 | 18,518 |

| Major investment scheme | Targeted transformation investment work | 1,430 | 1000 | 0 | 0 | 81 | 2,511 |

| Domestic heating improvements | Replacement of failed and obsolete heating systems, upgrading them with more efficient solutions to help address fuel poverty issues. | 2,426 | 3,232 | 3,295 | 4,002 | 4,017 | 16,972 |

| Door and window replacements | Continuation of the window replacement door replacement programme. Focused on medium rise blocks, but also picking up 'one off' whole house replacements | 737 | 910 | 481 | 484 | 487 | 3,099 |

| Decent Homes | Continuation of planned estate-based improvement work to the council's housing stock in accordance with decent homes and building safety principles, prioritised using stock condition data. | 6,510 | 15,186 | 15,310 | 13,492 | 15,117 | 65,615 |

| Contractual obligations | Preliminary costs associated with schemes | 2,134 | 2,169 | 2,205 | 2,241 | 2,286 | 11,035 |

| Fixed budget fees | Continuation of the rolling programme of condition surveys to enable effective asset management, options appraisals and the development of future investment schemes | 587 | 597 | 606 | 616 | 629 | 3,035 |

| Expectational works | |||||||

| Regeneration and demolition | Delivery of option appraisal outcomes - acquisition / conversion / demolition of unsustainable HRA assets. | 3,500 | 5,224 | 12,169 | 3,197 | 4455 | 28,545 |

| Housing developments | |||||||

| New-build/acquisition - various | Investment to create new council homes. | 2,340 | 10,080 | 22,944 | 20,436 | 10,023 | 65,823 |

| Other capital | |||||||

| ICT refresh | Replacement of IT hardware and software licences | 163 | 54 | 0 | 0 | 0 | 217 |

| Total housing capital budget | 28,090 | 50,892 | 67,963 | 54,041 | 47,405 | 248,391 | |

| Funded by | |||||||

| Major repairs reserve contributions | (19,114) | (18,877) | (18,768) | (18,585) | (18,457) | (93,801) | |

| Revenue contribution to capital | - | (10,951) | (3,220) | (3,860) | (4,239) | (22,270) | |

| HRA capital receipts | (8,217) | (14,844) | (11,847) | (6,499) | (5,599) | (47,006) | |

| Grant funding | (759) | (1,700) | (6,268) | (5,515) | (2,562) | (16,804) | |

| HRA borrowing | - | (4,520) | (27,860) | (19,582) | (16,548) | (68,510) | |

| Total funding | (28,090) | (50,892) | (67,963) | (54,041) | (47,405) | (248,391) |